The Hidden Mechanics of Family Wealth

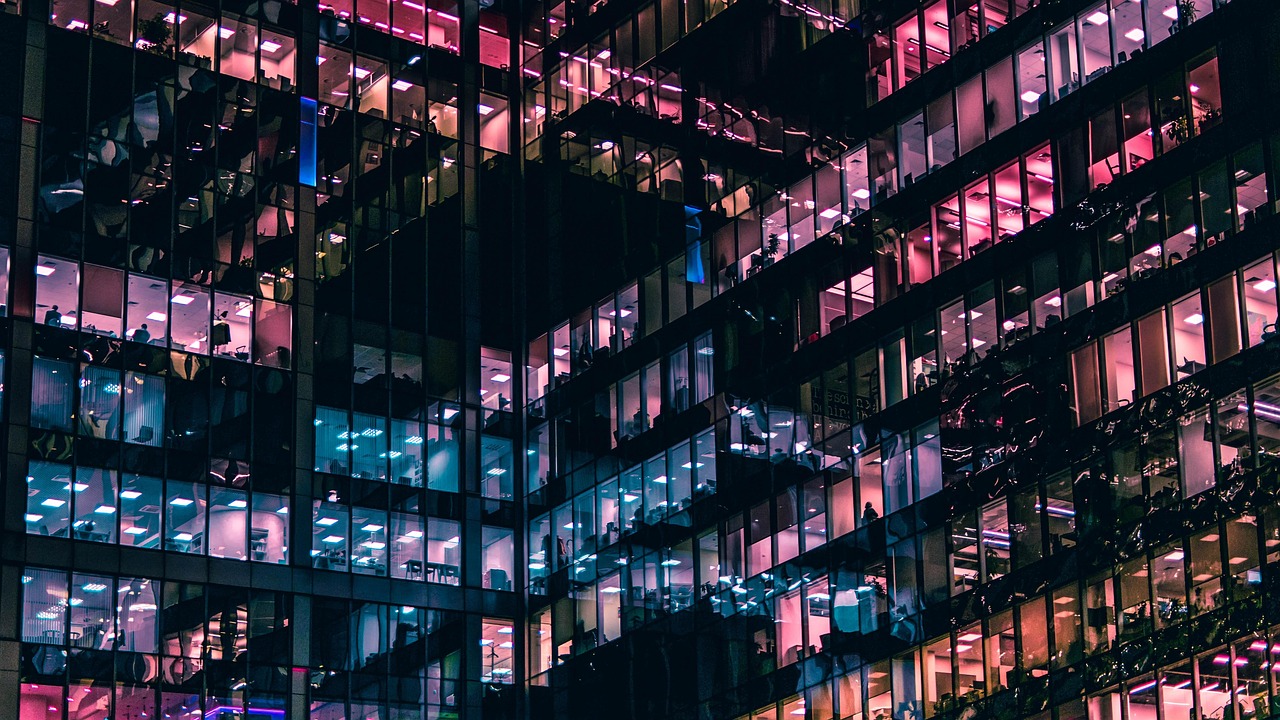

In the world of wealth, what we see is often only the surface. Grand houses, luxury cars, and private schooling catch the eye, but the true engine of enduring prosperity works quietly behind the scenes. It exists in structures designed to preserve and protect wealth, quietly shaping the future of families for generations. Among these structures, trusts stand out as the unsung architects of legacy. They influence not just financial outcomes but also family identity, values, and resilience in a changing world.

How Trusts Shape Generational Legacy

Trusts are, in essence, legal arrangements where one person, the trustee, manages assets on behalf of others, known as beneficiaries. At first glance, this sounds simple, but the real power of a trust lies in its hidden mechanics. They protect assets from creditors or unexpected challenges, allow families to minimize taxes, and ensure that wealth is passed down according to thoughtful plans. A trust can also control the timing and purpose of distributions, guiding heirs with subtle precision. And unlike a will, a trust often keeps a family’s financial life private, away from public scrutiny.

When we look at how trusts work across generations, their influence becomes even more apparent. Imagine a family spanning three generations. The first generation, often entrepreneurs or innovators, creates a trust to protect the fruits of their labor. They can embed their values and vision in its design, shaping not only financial outcomes but the way the family approaches wealth itself.

The second generation inherits both responsibility and opportunity. A trust can provide resources for education, starting a business, or charitable giving, while still offering guidance and oversight. It allows the family to nurture competence and responsibility in the next generation without handing over control all at once.

By the time the third generation arrives, trusts serve as a safeguard, preserving wealth through market fluctuations, tax changes, or unexpected life events. Multi-generational trusts can endure for decades, sometimes centuries, allowing a family’s mission, name, and values to persist long after the founder is gone. As the philosopher Seneca once said, “Luck is what happens when preparation meets opportunity.” Trusts are a form of preparation that turns opportunity into a lasting legacy.

In today’s world, the challenges and opportunities for trusts have grown even more complex. Families are no longer only passing down cash or property. Digital assets, cryptocurrencies, and complex investment portfolios now require trusts that can manage intangible wealth. Trustees must understand how to secure online accounts, safeguard digital collectibles, and ensure that technology does not undermine a family’s legacy. Global families face additional complexity as trusts must navigate cross-border tax laws and regulations. At the same time, many modern families use trusts to carry forward philanthropic missions, ensuring that wealth serves a purpose beyond the immediate family.

Trusts are more than legal and financial structures. They shape family culture. They teach discipline, delayed gratification, and shared responsibility. Families that communicate values alongside wealth often thrive, while those that do not can struggle with conflict and fragmentation. In this sense, a trust is both a guide and a teacher.

Seneca: “Luck is what happens when preparation meets opportunity.”

In a world marked by economic uncertainty and rapid change, trusts act as both anchor and blueprint. They quietly protect families from crises, guide financial decisions, and preserve values across generations. Their power is subtle but profound, showing that wealth is not only about what is visible but also about what is built to endure.

Ultimately, trusts transform wealth into something far greater than money. They turn it into a living legacy that connects generations, sustains family vision, and ensures that prosperity is paired with purpose. In this quiet architecture of enduring wealth, families find stability, foresight, and a bridge to the future.

How Trusts Work Across Generations

Imagine a family spanning three generations.

- First Generation (Founders): Entrepreneurs, innovators, or high-net-worth professionals often create trusts to protect the fruits of their labor. Beyond legal and financial goals, these trusts can embed values and vision, such as promoting education, entrepreneurship, or philanthropy within the family.

- Second Generation (Heirs): Adult children inherit not only wealth but also the responsibility of stewardship. Trusts can provide resources while setting conditions that encourage responsible decision-making, such as releasing funds for specific purposes or tying distributions to achievements.

- Third Generation (Legacy Keepers): By the time grandchildren receive wealth, trusts act as safeguards against volatility, ensuring assets survive market crashes, inflation, or shifts in tax law. Multi-generational trusts, often called dynasty trusts, are designed to endure for decades, preserving both financial stability and family mission.

Modern Challenges and Opportunities

The landscape of wealth today is more complex than ever. Families are not only passing down cash or real estate but also digital assets, cryptocurrency, and intricate investment portfolios. Modern trusts must address these realities:

- Digital Assets: Trustees must manage cryptocurrencies, online accounts, and NFTs, often creating digital succession plans and robust cybersecurity protocols.

- Global Families: International tax laws and multi-jurisdictional estate planning require trusts that can operate across borders without losing flexibility or compliance.

- Social Impact and Philanthropy: Many families use trusts to instill values and contribute to causes, integrating charitable giving directly into wealth planning through structures such as charitable remainder trusts or family foundations.

Trusts also shape family culture. They teach delayed gratification, shared responsibility, and discipline, while guiding heirs toward thoughtful use of resources. Families that align their values with their wealth often thrive across generations, while those that do not may face conflicts or fragmentation.

Precision in Practice: Examples

- A dynasty trust can preserve wealth for 100 years or more, providing income to multiple generations while protecting principal from taxes or creditors.

- Education-focused trusts may release funds only when a beneficiary reaches certain milestones, such as college graduation or completing entrepreneurial training.

- Charitable trusts allow families to give back consistently while reducing taxable income, aligning wealth with purpose.

By understanding these mechanics, families can tailor trusts to meet specific goals, whether financial, educational, or philanthropic.

Closing Reflections from Btrustor

Trusts are more than legal instruments or financial tools—they are the quiet architecture of enduring wealth. They connect generations, embed values, and protect families against both predictable and unforeseen challenges. In an era of digital assets, global mobility, and economic uncertainty, trusts provide stability, foresight, and adaptability, transforming wealth from a transient resource into a lasting legacy.

For anyone looking to build a family legacy, the lesson is clear: the true power of wealth lies not in accumulation, but in intentional preservation, thoughtful guidance, and intergenerational planning. Trusts make this possible, quietly working behind the scenes while families live, grow, and thrive.